A Team of Finance Students Spent Months Preparing an In-Depth Financial Analysis of a Tech Company. But Would Their Efforts Pay Off?

Benjamin Roe discusses his team’s analysis with visiting alumni and Finance chair Cyrus Ramezani, left. To his right is team member Jivitesh Kamboj. (Photo: Pat Pemberton)

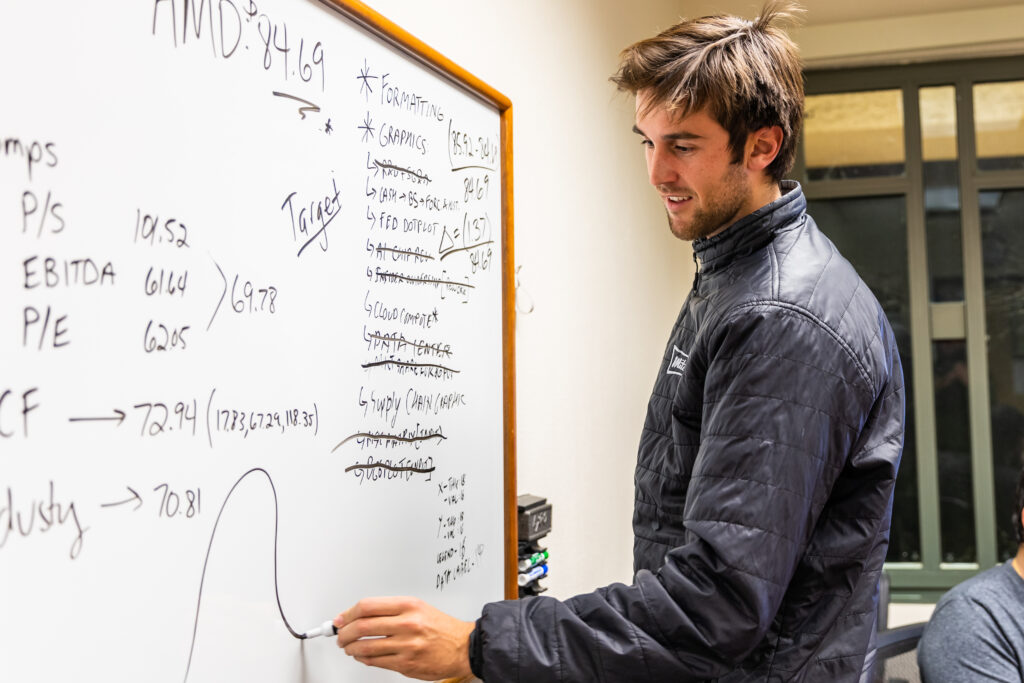

On a Wednesday evening in late February, the sky outside is beginning to darken when Brenden Rogers approaches a whiteboard in a small conference room, lifts a marker and writes “$85.92 target.”

Then he underlines “target” and returns to his seat.

With just two days before their 10-page investment analysis report is due for the CFA Institute Research Challenge, a team of Cal Poly finance students is cramming to finish the intensive research project they’ve been working on since autumn.

“I think we’re in a good spot,” says team member Jivitesh Kamboj a few minutes later, looking at the latest draft, which is projected on a smart TV.

The first line of their analysis recommends investors sell Advanced Micro Devices (AMD) stock with a one-year target price of $85.92, “providing an expected return of 3.26% from the current price.”

But with the countdown on, the report is still a little longer then required.

“We definitely have to cut the first page down,” Rogers says.

The multi-stage, CFA Investment Research Challenge competition includes over 6,400 students from 1,000 universities in 90 countries. While performing an in-depth analysis of a single company, students are tested on their analytical skills, valuation modeling, report writing and presentation skills. And, befitting Cal Poly’s Learn by Doing ethos, the competition entails experiential learning that mirrors real world work.

Specifically, the finished product will produce a comprehensive report that portfolio managers and finance professionals would rely upon to make investment decisions.

“This is an analyst initiation report,” said Cyrus Ramezani, faculty mentor on the project and chair of the Finance Area in the Orfalea College of Business. “The most detailed report issued on a firm by Wall Street analysts.”

The team is composed of five students – Jivitesh Kamboj, Brenden Rogers, Samantha Gottlieb, Athénaïs Mortier, and Benjamin Roe.

“We had all expressed interest in participating in this demanding project,” Roe said. “And then we all were selected to work together.”

To get this far, Mortier said, the team had to build trust in each other – “learning everyone’s strengths and how we all best work and fit in with each other’s personalities and skillsets.”

Advanced Micro Devices, Inc. (AMD) competes with Intel in the semiconductor industry, designing chips for computing applications. According to the team’s report, AMD “possesses a weak economic moat despite recent innovations.”

The report, chock full of graphics, figures and research, analyzes the industry, global competition, the regulatory environment, and AMD’s business model, customer base, and growth strategy.

“They have researched everything about this company. No stone has been left unturned,” Ramezani said.

For Ramezani, “the most impressive feature is the report’s breadth and the depth of analysis, which competes with the very best professional analysts on Wall Street publish”.

“The valuation models required forecasting demand for computers and computational devices over the next decade,” he said.

As the team worked 40-hour weeks in the period leading up to the deadline, they were nervous about factors that could influence the market in the final days.

“I keep getting scared that it’s going to change drastically, and everything we did for three weeks will need to be redone in one day,” Mortier said.

Yet, even with that uncertainty, the students were excited about preparing their project for the local presentation at the CFA Society of San Francisco.

“It has been a chance to apply a lot of the concepts I’ve learned in class – to actually get my hands dirty,” Roe said. “Getting all the research and synthesizing has been a big challenge and also a great learning opportunity.”

But first – that deadline.

The long conference table is topped with water bottles and empty sandwich wrappers. The room still smells like a Subway Turkey Cali sub – Roe’s favorite. And Mortier’s dog, Luna, a gentle whippet, lies quietly under the table.

“This is the final push,” Rogers explains.

Most of the work is done, but the report is about a half page too long.

“We definitely have to cut the first page down,” Rogers tells the team.

“Let’s just leave it for now until we have all the graphics in,” Gottlieb suggests.

Edits entail negotiation, Roe says outside of the room.

“There has definitely been some people wanting to keep their part in,” he explains. “It’s always a hard thing to negotiate that. We’re getting better and better at that.”

But with two days before the submission deadline, most of the final tasks entail simply making everything look outstanding.

Your support matters.

Your support helps advance student success both in an out of the classroom. Please consider giving to the Orfalea College of Business.

“There are plenty of things to talk about,” Roe said. “The struggle is more trying to make everything fit with our story and trying to have a coherent thesis that runs through the entire report.”

In the week before the San Francisco competition, several alumni view the team’s practice presentations and offer invaluable critique of the students’ research. The alumni include:

David Dudek (2010); Zack Georgeson (2000); Alexandra Joelson (2023); Brett Johnson (2001), Brad Johnson (2003); Dominic Juliano (2022); Tammy Kiely (1993); Scott Kirk (2004); Mason McCloskey (2018); Shingo O’Flaherty (2022); Samuel Paik (2022); Elena Perry (2020); Miles Wix (2016); Cameron Wong (2022).

In the end, the students’ perseverance and hard work results in an outstanding achievement: Two weeks after the final report is submitted, the team won the first place in Northern California competition, advancing to the sub-regionals. If the team continues to succeed, they will advance to the regional and global competitions.

But, best of all, the project has offered a detailed glimpse into their future.

“I think it’s a lot more detailed analysis than what we undertake in our course work,” Mortier said. “This is what we’re going to do in the future no matter which career path we chose within the finance industry.”